Uncategorized

Discounted Cash Flow Model Meaning, Calculation, Pros, Cons

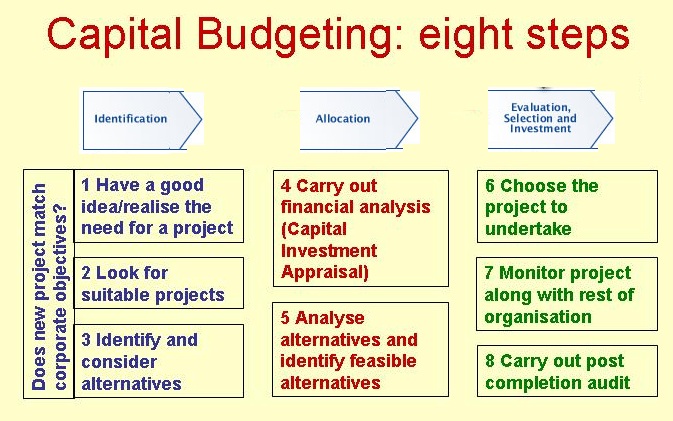

The method should be understandable to key stakeholders while providing meaningful insights for decision-making. This might include exploring joint ventures, strategic partnerships, lease tax filing options arrangements, or creative financing structures. Quick payback becomes particularly crucial in competitive markets where rapid adaptation and resource availability are essential.

Do you already work with a financial advisor?

The postage meter system would have an initial investment cost of $135,000. Annual net cash flows are $40,000 for the next 5 years, and the expected interest rate return is 10%. Calculate net present value and decide whether or not Yellow Industries should invest in the new postage meter system. The discounted payback method may seem like an attractive approach at first glance. On closer inspection, however, we find that it shares some of the same significant flaws as the simple payback method.

What Is the Discounted Cash Flow (DCF) Model?

Organizations must consider factors such as depreciation benefits, tax shields from debt financing, investment tax credits, and international tax regulations. Market conditions also affect the availability and cost of financing options. Organizations must carefully analyze market trends, consumer behavior, competitive dynamics, and economic indicators to assess project viability. Organizations must analyze various risk factors, including market volatility, operational challenges, competitive threats, and economic uncertainties. It encompasses both the cost of debt and equity financing, reflecting the organization’s financial structure and risk profile. Organizations determine the most appropriate funding sources for selected projects.

Discounted Cash Flow Models (DCF): Guide and Examples

It’s beneficial to employ various scenarios and sensitivity analyses to understand the range of possible outcomes and intrinsic risks. Discounted cash flow (DCF) analysis is a method used in corporate finance and valuation to estimate the attractiveness of an investment opportunity. DCF analysis uses future free cash flow projections and discounts them to arrive at a present value estimate, which is used to evaluate the potential for investment. Two, select a discount rate, typically based on the cost of financing the investment or the opportunity cost presented by alternative investments.

Efficient capital allocation process

Consideration must be given to potential technological obsolescence and the need for future upgrades or replacements. To find the overall present value, the following calculations take place using the Present Value of $1 table. To find the overall present value, the following calculations take place using the present value of $1 table. Alternatively we can use present value of $1 table to obtain these factors.

What Does the Discounted Cash Flow Formula Tell You?

- The pace of technological advancement significantly influences capital budgeting decisions, particularly in technology-intensive industries.

- Volopay is able to seamlessly integrate with existing accounting software, ensuring automatic synchronization of financial data.

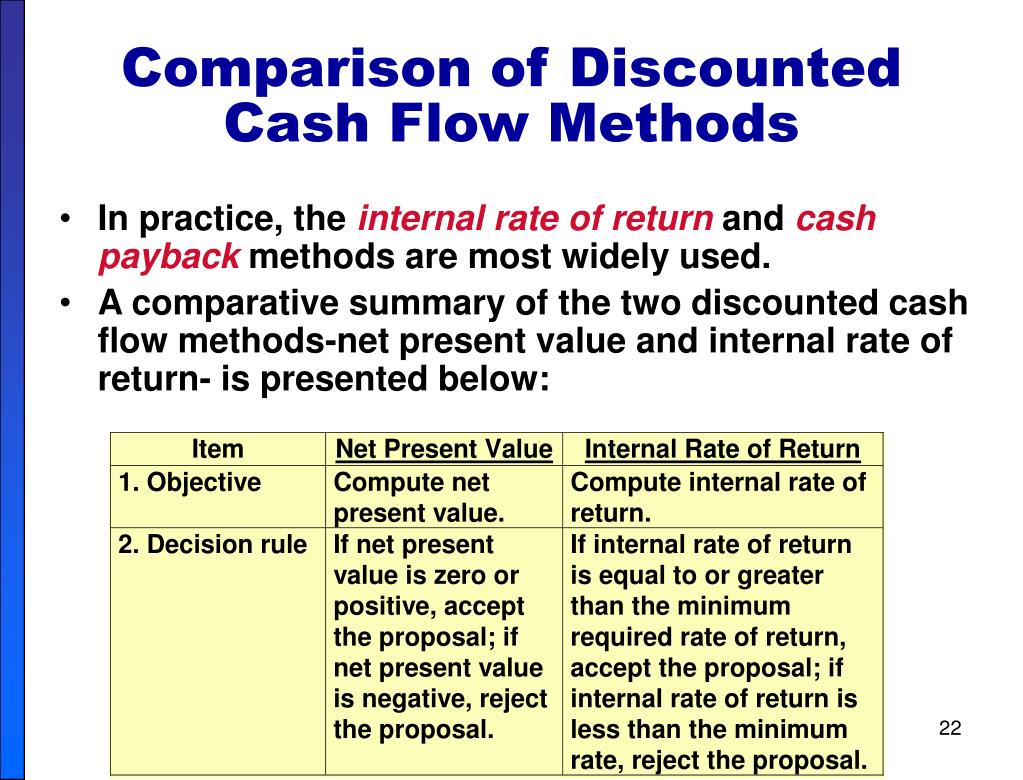

- To decide the best option between alternatives, a company performs preference measurement using tools, such as net present value and internal rate of return that do consider the time value of money concept.

- This is because the DCF model estimates a company’s value based on its expected cash flows.

- Payback period is a capital budgeting technique that determines the time required to recover the initial investment of a project through its cash inflows.

Like regular payback period, it ignores cash flows after the recovery point. It doesn’t measure profitability directly and may lead to rejection of profitable long-term projects. Setting appropriate discount rates can be challenging in uncertain markets. Then, calculate cumulative cash flows year by year until they equal or exceed the initial investment. A second flaw is the lack of consideration of cash flows beyond the payback period.

To learn more about the various types of cash flow, please read CFI’s cash flow guide. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

If the net present value of a project or investment is negative, then it is not worth undertaking, as it will be worth less in the future than it is today. Thus, you can see that the usefulness of the IRR measurement lies in its ability to represent any investment opportunity’s possible return and compare it with other alternative investments. Based on this outcome, the company would invest in Option A, the project with a higher profitability potential of 1.157. The principle behind determining the correct discount rate to use is that the discount rate needs to adequately reflect the riskiness of the business being valued. We need to know this sum total number so we can add it to the other three years of cash flows, to get the full value of the company’s entire life.

As you will see, the present value of equal cash flow payments is being reduced over time, as the effect of discounting impacts the cash flows. The internal rate of return model allows for the comparison of profitability or growth potential among alternatives. All external factors, such as inflation, are removed from calculation, and the project with the highest return rate percentage is considered for investment. The postage meter system would have an initial investment cost of \(\$135,000\). Annual net cash flows are \(\$40,000\) for the next \(5\) years, and the expected interest rate return is \(10\%\). Choose a method that appropriately handles your expected cash flow patterns.

This analysis helps organizations prepare for various possibilities and develop appropriate contingency plans for different situations. Organizations should engage key personnel from finance, operations, marketing, and other relevant departments to ensure comprehensive project evaluation and better buy-in for implementation. Organizations should consider broader economic trends, competitive dynamics, regulatory changes, and technological developments that might affect project outcomes over time.