Uncategorized

Investment Decisions Notes & Practice Questions CMA

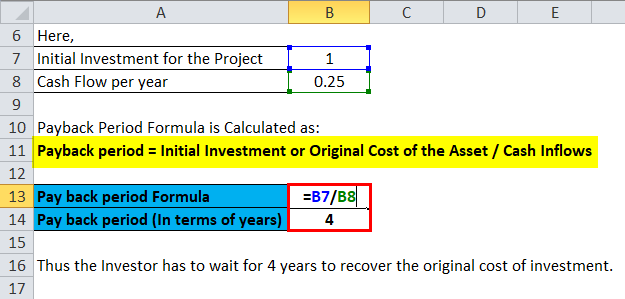

The investor also considers their risk tolerance and investment horizon, deciding whether to invest for short-term gains or long-term growth, thus reflecting a strategy based on personal financial goals. The project has an initial investment of $1,000 and will generate annual cash flows of $100 for the next 10 years. According to payback method, the project that promises a quick recovery of initial investment is considered desirable. If the payback period of a project is shorter than or equal to the management’s maximum desired payback period, the project is accepted, otherwise rejected. For example, if a company wants to recoup the cost of a machine within 5 years of purchase, the maximum desired payback period of the company would be 5 years.

Payback Period Calculation Example

The second project will take less time to pay back, and the company’s earnings potential is greater. Based solely on the payback period method, the second project is a better investment if the company wants to prioritize recapturing its capital investment as quickly as possible. The payback period disregards the time value of money and is determined by counting the number of years it takes to recover the funds invested. For example, if it takes five years to recover the cost of an investment, the payback period is five years. For example, if solar panels cost $5,000 to install and the savings are $100 each month, it would take 4.2 years to reach the payback period.

Comparing Payback Period with Other Methods

The breakeven point is the price or value that an investment or project must rise to cover the initial costs or outlay. The payback period refers to how long it takes to reach that breakeven. Getting repaid or recovering the initial cost of a project or investment should be achieved as quickly as it allows. However, not all projects and investments have the same time horizon, so the shortest possible payback period needs to be nested within the larger context of that time horizon. For example, the payback period on a home improvement project can be decades while the payback period on a construction project may be five years or less.

Capital Expenses

Another limitation of the payback period is that it doesn’t take the time value of money (TVM) into account. The time value of money is the idea that cash will be worth more in the future than it is worth today, due to the amount of interest that it can generate. This is another reason that a shorter payback period makes for a more attractive investment. An investor chooses to buy shares of a technology company after analyzing its financial health, growth potential, and industry trends. This decision involves researching the company’s earnings reports, market position, and competitive advantages.

Cash Flow and Liquidity Management

Discounted payback period serves as a way to tell whether an investment is worth undertaking. The lower the payback period, the more quickly an investment will pay for itself. He’ll have no sooner finished paying off the machine, then he will have to buy another one. Perhaps in his case the profit might be worth it, depending on what else is going on in his business. However, it’s likely he would search out another machine to buy, one with a longer life, or shelf the idea altogether.

- It is predicted that the machine will generate $120,000 in net cash flow every year.

- For example, if a company wants to recoup the cost of a machine within 5 years of purchase, the maximum desired payback period of the company would be 5 years.

- Others like to use it as an additional point of reference in a capital budgeting decision framework.

- Longer payback periods are not only more risky than shorter ones, they are also more uncertain.

- The discounted payback period is often used to better account for some of the shortcomings, such as using the present value of future cash flows.

More specifically, it’s the length of time it takes a project to reach a break-even point. The breakeven point is the level at which the costs of production equal the revenue for a product coronavirus stimulus checks or service. In summary, the payback period and its variant, the discounted payback period, serve as useful initial screenings for investment projects, focusing on liquidity risk.

The way a company finances its operations, through debt or equity, influences its risk level and flexibility in pursuing growth. Investing in real estate involves purchasing physical properties (residential, commercial, or industrial) or investing through Real Estate Investment Trusts (REITs). In case the sum does not match, then the period in which it lies should be identified. After that, we need to calculate the fraction of the year that is needed to complete the payback. On the other hand, Jim could purchase the sand blaster and save $100 a week from without having to outsource his sand blasting. First, we’ll calculate the metric under the non-discounted approach using the two assumptions below.

A conservative investor opts to purchase government bonds as part of a fixed-income strategy. This decision is made to secure a steady income stream with lower risk compared to stocks. The investor assesses the bond’s interest rate, maturity, and the issuing government’s creditworthiness. By investing in bonds, the investor aims to preserve capital while earning interest, balancing their portfolio to mitigate volatility. The equation does not calculate cash flows in the years past the point where the machine is expected to be paid off. It’s possible those cash flows will be higher than the previous years.